Taiwan s tax 20% has caused three major shocks! The Ministry of Economic Affairs revealed that these four industries are "maligned"

US President Trump announced today (1st) that Taiwan's taxes were 20%, higher than Japan and South Korea's 15% and Thailand's 19% and the same tax rate as Vietnam. At present, the Ministry of Economic Affairs has also issued a "Research on the Impact of Trump on Other Taxes on my country's Industry" to share the possible impact of taxes on Taiwan's industry.

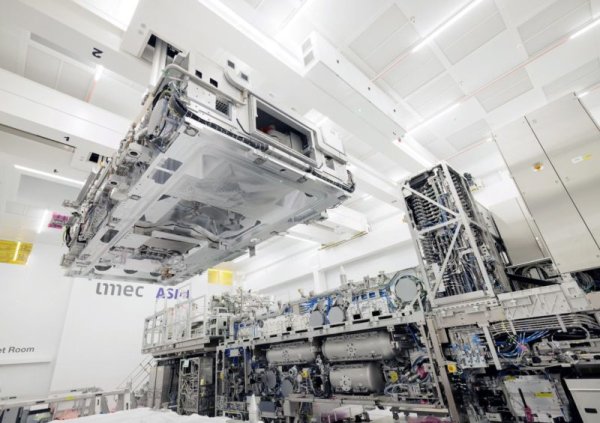

The Economic Department's report pointed out that if the three directions of trade, investment and technical analysis are analyzed, the first impact of trade includes: the increase in the US cost of Taiwanese industrial products, which affects the profitability of the industry; the withdrawal of tax pressure and the factory may try to transfer from a third place (change the original product). ) has led to reconfiguration of trade flows; in terms of tools, molds, plastic products and electronic materials and other industries, Japan is the main competition in Taiwan in the US market, and the continued net value of Japanese currency in recent years, which is not conducive to the competition for product price in Taiwan; currently, taxes on electronic products such as semiconductors are still ongoing. In terms of clause 232, it is not affected by 20% of the relevant taxes, and the progress and taxes of the United States must continue to be observed.

In the investment area, Taiwan's tax levy on raising tax responsibilities may prompt enterprises to accelerate the migration of production bases to the United States or other lower tax dependent countries (such as Mexico), resulting in the outward movement of industries. In addition, if Taiwan’s role in the global supply chain is weakened due to tax-related policies, the willingness of international funds to invest in Taiwan may decline.

Finally, there is technology. Since Japan's taxes are lower than those in our country, it may prompt enterprises to accelerate their investment and investment factories in Japan and the United States or locally manufactured. R&D centers and talent cultivation resources may also be moved away, causing Taiwan's local innovation energy to be diluted; in addition, small and medium-sized enterprises with poor anti-strike capabilities will cause a technical gap in the industry ecosystem, affecting the overall industrial competitiveness and competitiveness.

The report also analyzes the impact of an individual industry and mentions the possibility of impacting the tool machine. Therefore, the Ministry of Economic Affairs recommends that the Department of Economic Affairs help operators clear product classification and compete for tax preferential certification; suggests that the government provide export conversion assistance and operation loans; and assists in explaining and cooperating with transitional operation plans.

In addition, in the mold part, Japan is the main competition country, so the 15% tax rate is still advantageous compared to Taiwan, and the Ministry of Economic Affairs also recommends a stable exchange rate.

As for the communication industry, although the tax base of competition is similar to that of Taiwan, the Ministry of Economic Affairs will still help manufacturers invest more resources in the research and development of core technologies such as B5G/6G, Wi-Fi 6E/7 and Internet of Things, enhance product competitiveness, and promote the application of AI smart manufacturing technology; continue to help manufacturers develop diversified markets and reduce their dependence on the US market.

Another noteworthy is that in the report appendix, the Ministry of Economic Affairs mentioned that the export proportion of information hardware in 2024 was 95.0%, of which the U.S.-based ratio was 60.0%, which caused the output value to reach -14.46%. In other words, Taiwan's information hardware equipment sells more than half of the United States. Once the US class charges taxes, it will directly impact the main customer group. This is mainly a structural impact and the risk is significant. In this regard, the Ministry of Economic Affairs’ recommendation for the allocation of hardware is to maintain existing subsidies and enhance the administrative support of the industry in the US investment equipment.

Extended reading: Taiwan tax 32%→20%! They stood on the first line and had to know the three "discussing female power" that they must know Trump's 20% tax on Taiwan classes is higher than in Japan and South Korea! How to get rid of the conditions for judging? 232 Terms of Development