Faraday Q3 earned 0.58 yuan per share and has received new 4nm AI ASIC cases

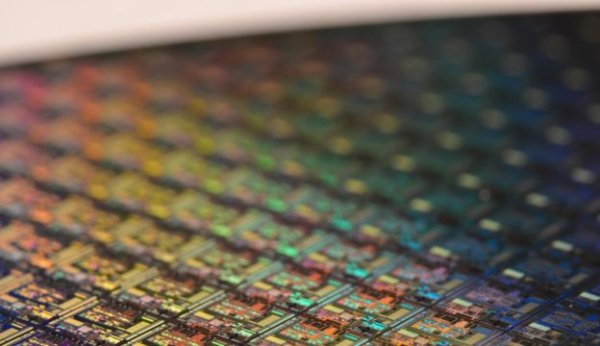

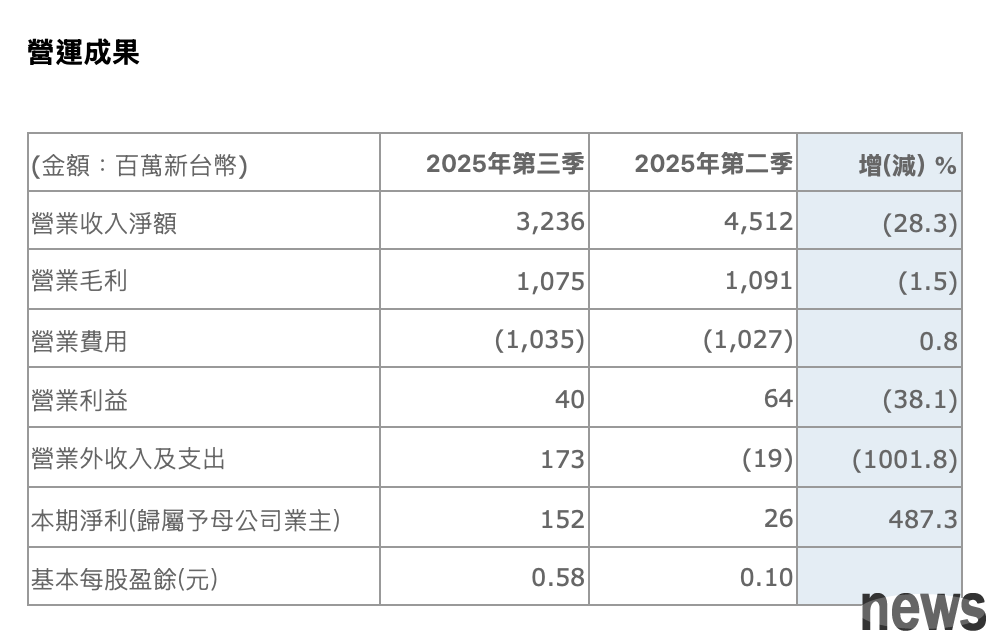

Faraday Technology, a leader in ASIC design services and silicon intellectual property (IP) R&D and sales, today (28th) announced its third quarter consolidated financial statements. Consolidated revenue was NT$3.24 billion, a quarterly decrease of 28% and an annual increase of 12%. The gross profit margin was 33.2%. The net profit attributable to the owners of the parent company was NT$150 million, and the basic earnings per share was NT$0.58.

Reviewing the third quarter, consolidated revenue was NT$3.24 billion, a 28% decrease from the previous quarter, but still an increase of 12% from the same period last year. Faraday pointed out that from the perspective of product structure, IP revenue performance was outstanding, reaching 410 million yuan, with a quarterly increase of 43%, but a slight decrease of 7% from the historical high in the same period last year; NRE revenue climbed to 490 million yuan, an increase of 19% from the previous quarter, but the increase did not meet expectations due to customers adjusting the case filing schedule, a decrease of 24% from the same period last year; mass production (MP) revenue decreased by 39% from the previous quarter, to 23.3 billion, but still increased by 30% compared with the same period last year.

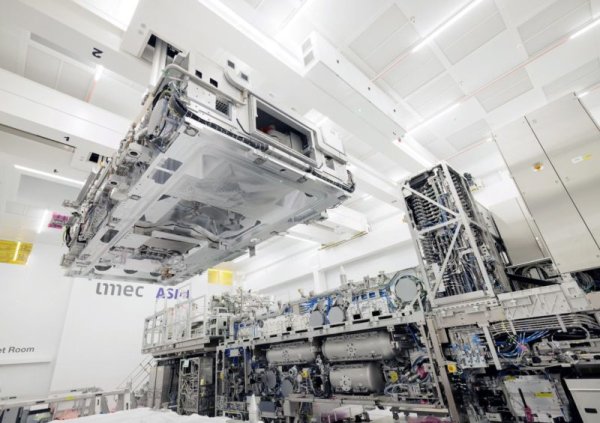

Faraday stated that the company continues to deepen its two major engines of advanced process and advanced packaging and has made breakthrough progress. It has not only successfully won new 4nm AI ASIC projects, but also won new 2.5D and 3D advanced packaging projects from North American customers. In terms of foundry strategy, Faraday adopts a Multiple Foundry Strategy for advanced manufacturing processes and has established strategic partnerships with four major international foundry partners. Currently, it has fully mastered the process design kits (PDKs) of each partner and has officially launched a design platform to undertake customer projects. This layout not only meets the needs of customers to diversify geographical risks, but also highlights its strategic value in the recent wave of semiconductor supply chain restructuring.

Looking forward, although the overall revenue in the fourth quarter is expected to experience a short-term retracement, Faraday’s full-year revenue is still expected to reach a record high.

Faraday pointed out that in the face of changes in the international market, the company's multi-source foundry strategy provides supply chain resilience to reduce single supplier risks and geopolitical impacts; at the same time, by deploying the process advantages and production capacity allocation of different foundry partners, it can enhance the flexibility of advanced packaging and heterogeneous integration, achieve the best technology mix, and more importantly, meet policy compliance and localized production requirements. In the medium to long term, the accumulation of advanced processes and advanced packaging design cases, coupled with the layout of global manufacturing and packaging networks, will help the company increase the added value of its overall solutions and consolidate its market competitive advantage.

Further reading: SK Hynix M15X factory imports equipment two months ahead of schedule to accelerate HBM chip production expansion Qualcomm officially enters the AI chip market! New products AI200 / AI250 will be unveiled next year, and the stock price soared by more than 20%