ASE Investment Holdings will increase capital expenditure again, and advanced packaging and testing revenue is expected to be good next year

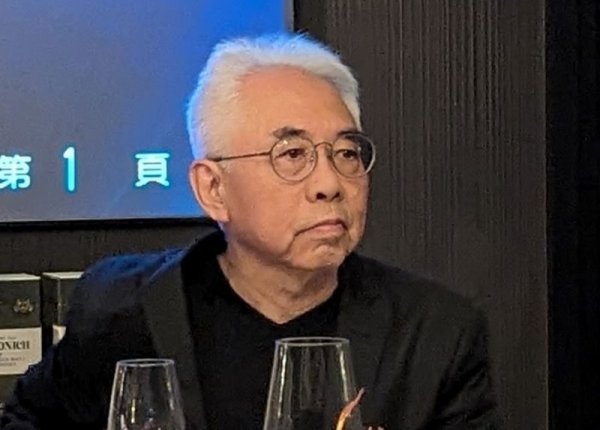

Dong Hongsi, chief financial officer of ASE Investment Holdings, a packaging and testing company, today estimated that consolidated revenue in the fourth quarter is expected to increase by 1% to 2%, and packaging and testing business is expected to increase by 3% to 5%. This year’s packaging and testing business’s US dollar-denominated performance will significantly increase by more than 20% year-on-year. This year’s advanced packaging and testing revenue will reach the target of US$1.6 billion, and will increase by another US$1 billion in 2026.

Looking forward to capital expenditures, Dong Hongsi said that in response to the strong overall market demand in 2026, ASE Investment Holdings will increase capital expenditures by billions of dollars this year. The scale of capital expenditures has been continuously increased this year, including projects such as machinery and equipment, factory construction and related facilities. The legal person expects that ASE Investment Holdings’ capital expenditure this year will exceed US$6 billion.

ASE Investment Holdings held an online legal person briefing in the afternoon. Looking forward to fourth-quarter operations, Dong Hongsi said that based on business situation assessment and exchange rate assumptions, 1 U.S. dollar exchanges for NT$30.4, priced in NT$, fourth-quarter consolidated revenue will increase by 1%~2% quarterly, gross profit margin will increase by 0.7% to 1% quarterly, and operating profit rate will increase by 0.7% to 1% quarterly.

For the packaging and testing business, Dong Hongsi said that if priced in New Taiwan dollars, revenue in the fourth quarter would increase by 3% to 5% quarter-on-quarter, and gross profit margin would increase by 1 to 1.5 percentage points quarter-on-quarter.

Electronic foundry services, priced in New Taiwan dollars, revenue was flat or slightly lower than the third quarter, and operating profit margins were similar to the fourth quarter of 2024.

Looking at the utilization rate in the third quarter, ASE Investment Holdings pointed out that the average capacity utilization rate of the packaging business is about 70% in the upper range.

Looking forward to the performance of advanced packaging and testing this year, Dong Hongsi pointed out that ASE Investment Holdings’ advanced packaging and testing performance this year can reach the estimated target of US$1.6 billion, with 65% coming from advanced packaging and 35% coming from advanced testing.

Dong Hongsi predicts that ASE Investment Holdings’ overall packaging and testing performance this year will significantly increase by more than 20% compared to last year if measured in US dollars. This year’s testing performance growth rate will be twice that of packaging performance.

Looking forward to 2026, Dong Hongsi expects that artificial intelligence (AI) and high-performance computing (HPC) applications will continue to drive ASE Investment and Control’s advanced packaging and testing performance next year, and next year’s advanced packaging and testing performance will increase by another US$1 billion.

On the testing side, ASE Investment Holdings is currently targeting an increase in wafer testing capacity, and finished product testing capacity is also planning to continue to expand in response to testing needs related to AI and HPC applications next year.

Further reading: Better than expected and hitting an 11-quarter high, ASE Investment Holdings’ third-quarter EPS reached 2.5 yuan