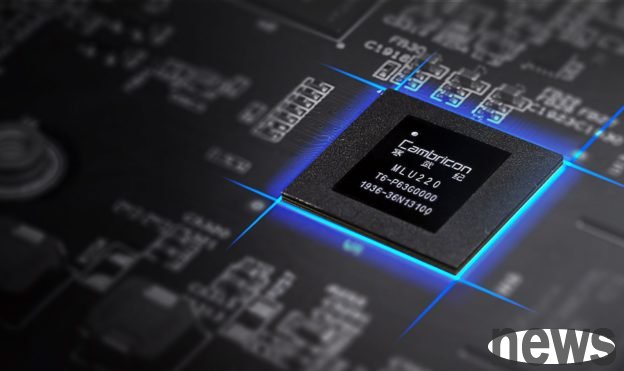

Cambrian became the king of Chinese stocks, with a price-to-earning ratio of 595 times bubbles

The stock price of China's artificial intelligence chip Longtou Cambrian once again surged today, surpassing the precious marshmallow Moutai and officially ranked as the Chinese A-share king. With the crazy pursuit of funds and investors, Cambrian's P/E ratio is as high as 595 times today, and the risk of operation and bubble crisis emerged.

Combined with the 21st Century Economic Report, Interface News, Sina Finance and other Chinese media, the three major A-share indexes rose across the board today, with the C-listed Science and Technology Innovation Board chip index rising by 8.45%, and the constituent stock Cambrian closed up by 15.73%, with a share price of 1,587.91 RMB (about NT$6,780, the same below), surpassing the NT$1,446.1 RMB, officially becoming the A-share king. Cambrian's 27th plate surpassed the precious marsh Moutai in a short period of time, and today it even surpassed the precious marsh Moutai far away.

Cambrian's total market value reaches RMB 664.3 billion, even surpassing the semiconductor big brother SMIC's international A-share market value of RMB 580.4 billion. But Cambrian's P/E ratio is also as high as 595.33 times, and the risk of operation and bubble crisis emerge.

Cambrian's success is the reason why the US restricts chip exports from China and NVIDIAH20 production suspension incident, creating a key market vacuum for China's domestic AI chips. Cambrian also accurately focuses on the big model computing power competition, and cloud smart chips and supporting products are in the "domestic substitution" vogue.

Secondly, Cambrian was included in many important indexes and became an important driving force for the rise in stock prices. As early as March 15, 2021, the company will be included in the 500 certificate in 2023; the company will be included in the 50 certificate in 2024 and the company will be included in the 50 certificate in the 50 certificate in the 50 certificate in 2024. Cambrian also attracted a large number of fund products to pay attention and configure. Currently, many fund products re-hold Cambrian, with some products exceeding RMB 20 billion.

However, many images show that Cambrian's operating risks and valuation bubble are gradually emerging.

One is high inventory pressure. In the first half of the year, the inventory balance of Cambrian reached RMB 2.69 billion, an increase of 51.64% from the end of last year, accounting for more than 30% of the total assets. The commissioned processing property income reached RMB 1.531 billion, representing the company to adopt the "stacking inventory, locking production capacity" strategy.

The second is customer concentration risk. The five major Cambrian customers' contributions are 85.31% of the accounts and contract assets, and are highly dependent on a small number of customers. In addition, the bad account preparations of up to 50.71% were raised for some accounts that should be collected, reflecting the problem of "easy delivery and difficult collection".

The third is the uncertainty of supply chains. Cambrian adopts the Fabless (unsemiconductor company) model and relies on foundry factories such as Taiwan Electric Power. The company and some subsidiaries have been included in the "physical list" in the United States. The chip design software (EDA) and advanced process resources may be limited.

In addition, Cambrian valuation is relatively high. Today's closing price-to-earnings ratio was as high as 595.33 times, far exceeding the median value of A-share semiconductor products of 137.25 times; SMIC's closing price-to-earnings ratio today was 209.44 times.

Although 269 funds increased their holdings in Cambrian in the second quarter, 119 funds chose to reduce their holdings, and the total number of funds held 67.0963 million shares, a sharp decline from 97.7788 million shares in the second quarter of 2024, a low of nearly two years, indicating that some institutions have made profits, injecting rational temperature reduction agents into the biggest capital craze in A-shares.

Extended reading: Cambrian once surpassed the Marine Maotai in today's market, becoming the new A-share stock king Cambrian won Goldman Sachs to raise its target, and it once forced 1,400 RMB in the market today Cambrian Chinese stock price has exceeded 1,200 yuan today, surpassing SMIC's market value